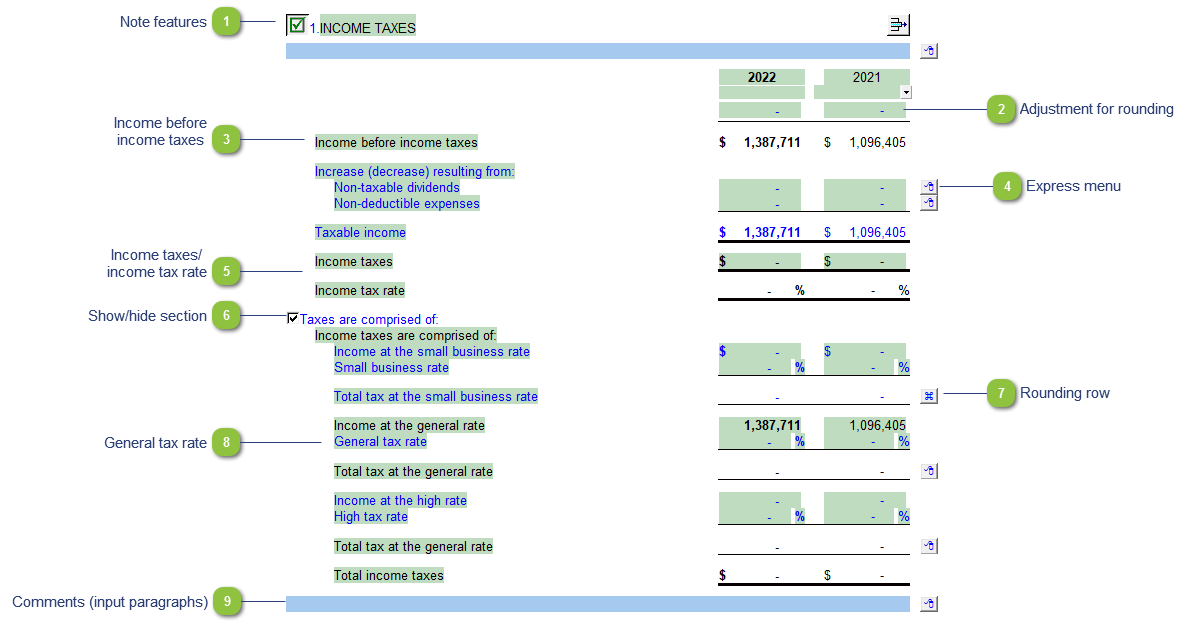

Reconciliation of Income Tax Expense - Format 2

Note features Each note has a series of common features. Refer to Common Note Features for more information on each feature. |

Adjustment for rounding Type rounding amount to round the note if necessary. The amount is rounded to the designated rounding line as indicated by the  . |

Income before income taxes The income before taxes amounts are transferred from the Income Statements.

|

Express menu Right-click on the express menu to insert more linked or manual lines, insert subtotals, sort and delete current lines where the options are available. |

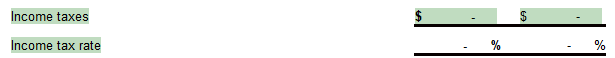

Income taxes/ income tax rate The income tax amount and the income tax rate is transferred from the Taxes are comprised of in the table below.

|

Show/hide section Click on the folder icon to show or hide the Taxes are comprised of section.

|

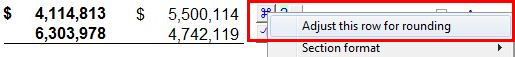

Rounding row To apply the rounding difference to a row, right-click on the express menu ( ) ) and select Adjust this row for rounding. The  indicates the designated rounding line.

|

General tax rate Enter the general tax rate. This rate will be transferred to the Income tax rate line item in the table above.

|

Comments (input paragraphs) You can edit existing input paragraphs or insert more paragraphs using the express menu. Refer to Input Paragraphs for more information on inserting paragraphs. |

|