Option to net balances recoverable/payable on the balance sheet?

Certain balance sheet recoverable/payable items can be shown as netted or separate. This is helpful in fulfilling specific presentation requirements or preferences. An example is federal/provincial income tax. When one jurisdiction is in a debit position and the other is in a credit position, the balance sheet can show amounts either separately or netted. Note that long term balances cannot be netted against current balances.

Using the option to net amounts

The option to net recoverable / payable amounts is available for the following balance sheet items:

-

Corporate taxes (provincial and federal)

-

Due from (to) related parties

-

Due from (to) shareholders

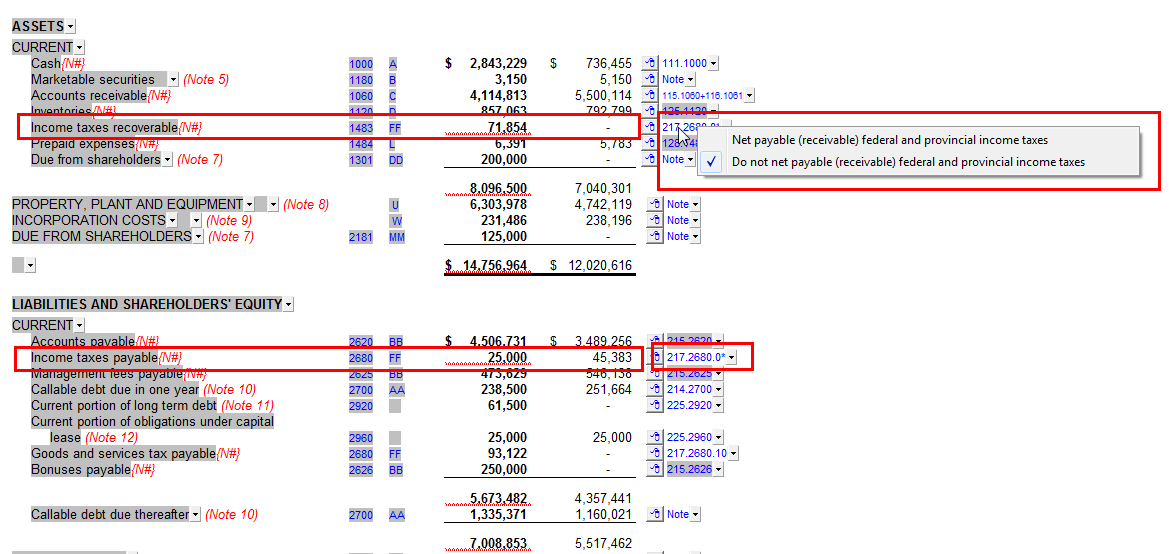

Example 1 (Corporate taxes):

In the example below we have a credit balance of $25,000 for Provincial taxes payable and a debit balance for Federal taxes payable of $71,854.

Right-click on the either dropdown that displays the map number 217.2680.0*. The screenshot below shows the balances as separate.

This is what the balances display when netted.

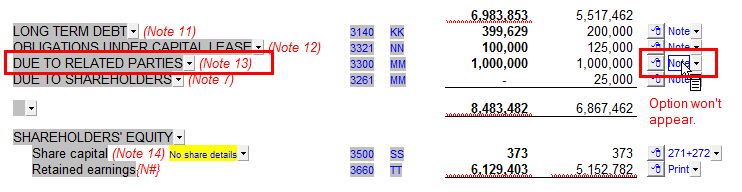

Example 2 (Related parties and shareholders)

To access this option, right-click on the map number of the affected line item.

Please note that this option will not be available if the amount is linking from a note. This will be indicated by a Note in the dropdown. Delete or deactivate the related note to enable the option.