How do I record a prior period adjustment in my Jazzit financial statements?

You need to consider the effects on the retained earnings opening balance when posting a prior period adjustment. If the retained earnings is affected, the Statement of Retained Earnings should be amended to show a restatement.

A prior period adjustment will be posted twice; the first journal entry will be posted in the prior year to correct the balances in the comparative year, the second journal entry will be posted in the current year to correct the opening balances for the balance sheet and retained earnings.

|

|

The ability to show the restated retained earnings on the Statement of Retained Earnings in the Jazzit financial statements is available when the client profile is set to Limited company, Sole proprietor, PSAB (9 Column) Not for Profit (9 column – format B)

|

Solution

Let us look at the following example:

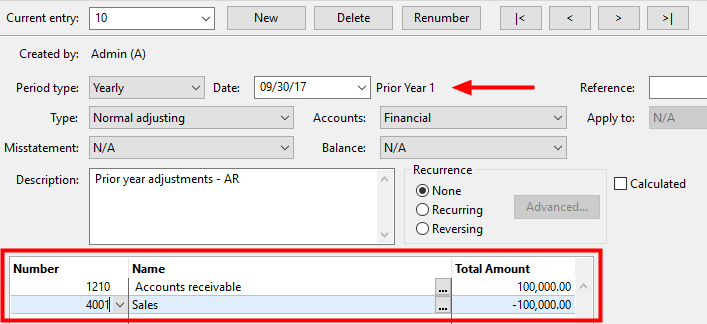

The prior year sales understated by $100,000 and was not recorded until the current year. The prior year entry to correct this error would be as follows:

|

Accounts receivable

|

Dr - $100,000

|

|

Sales

|

Cr - $100,000

|

Posting the adjusting entry in CaseWare Working Papers

The journal entries will be posted in CaseWare Working Papers as follows:

-

Create a new account called Prior period adjustments. To create a new account, go to the Working Trial Balance using the Navigation toolbar or use the CTRL + W hotkey to open the Working Trial Balance.

-

Go to Account > New Account or click on the New button in the top left corner of the screen.

-

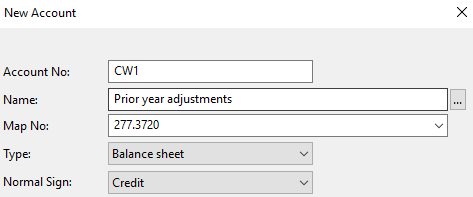

Complete the following fields in the New Account dialog:

-

Account No: Enter a new account number.

-

Name: Enter the account name, e.g. Prior period adjustments.

-

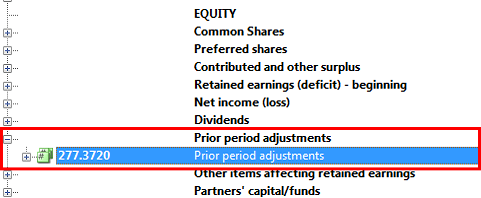

Map No: Map the new account number. The Prior period adjustments account should be mapped to map number 277.3720.

-

-

Click on OK to continue.

-

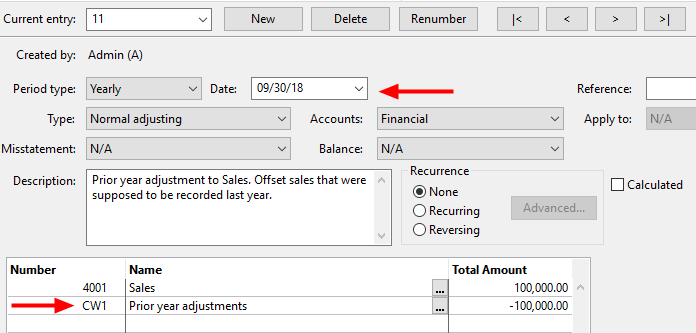

Open the Adjusting entries screen (CTRL + J) and enter the journal entries as follows:

-

Prior year: The journal entry is posted to the prior year as it should have been originally entered. Remember to change the journal entry date to the prior year-end date.

-

Current year: The journal entry should be reversed in the current year, however, as per the example, we will be posting the accounts receivable portion to the new Prior period adjustments account. This is to ensure that the opening balance of the Retained earnings shows as being restated.

Showing the prior period adjustment in the Jazzit financial statements

-

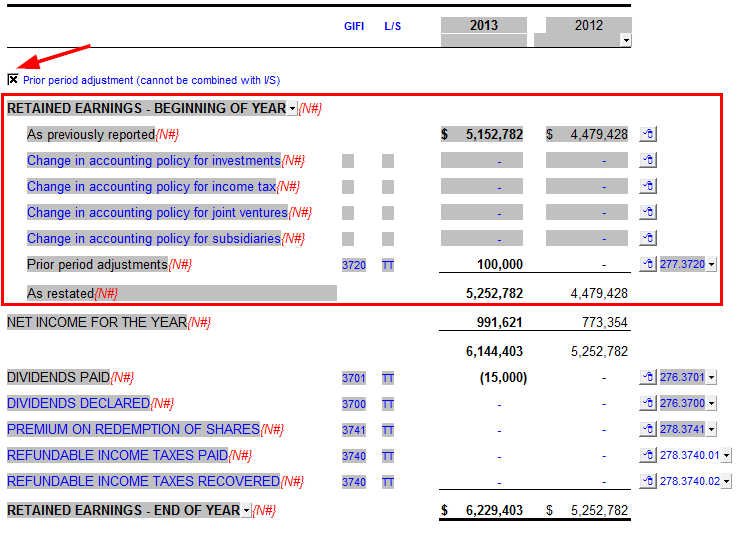

Open the Jazzit financial statements and jump to the Statement of Retained Earnings.

-

Check the Prior period adjustments check box to turn the section on.

-

You will note that the As previously reported balance has been automatically populated using the mapped information for map number 274.3660. This balance represents the retained earnings balance as reported BEFORE the prior period adjustment.

-

You also have the ability to manually enter the balances. The override indicator (red dot) will show that the value has been manually changed. Right-click on the overridden cell to restore the original balance.

-

-

The posted journal entry amount(s) will show next to the Prior period adjustments description if you have mapped the account correctly (see page 2).

-

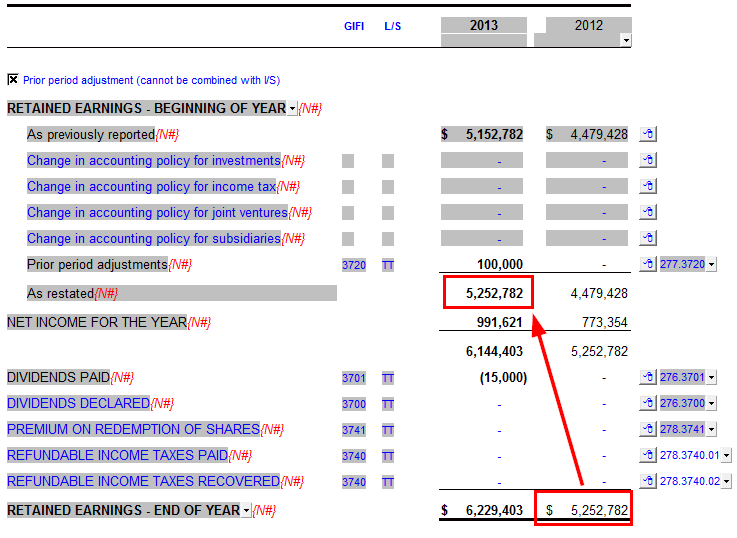

The retained earnings for the current year will be restated by adding the prior period adjustment to the As previously reported balance.

-

The prior year closing retained earnings for the year should equal the As restated balance in the current year.

-

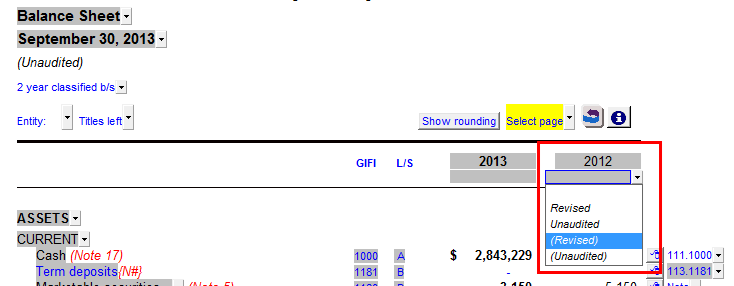

You can use the drop-down menu located at the top of each statement to add the Revised/Restated description to the prior year column headings (this can be found under the Columns settings folder above each statement when using the 9 columns statements).