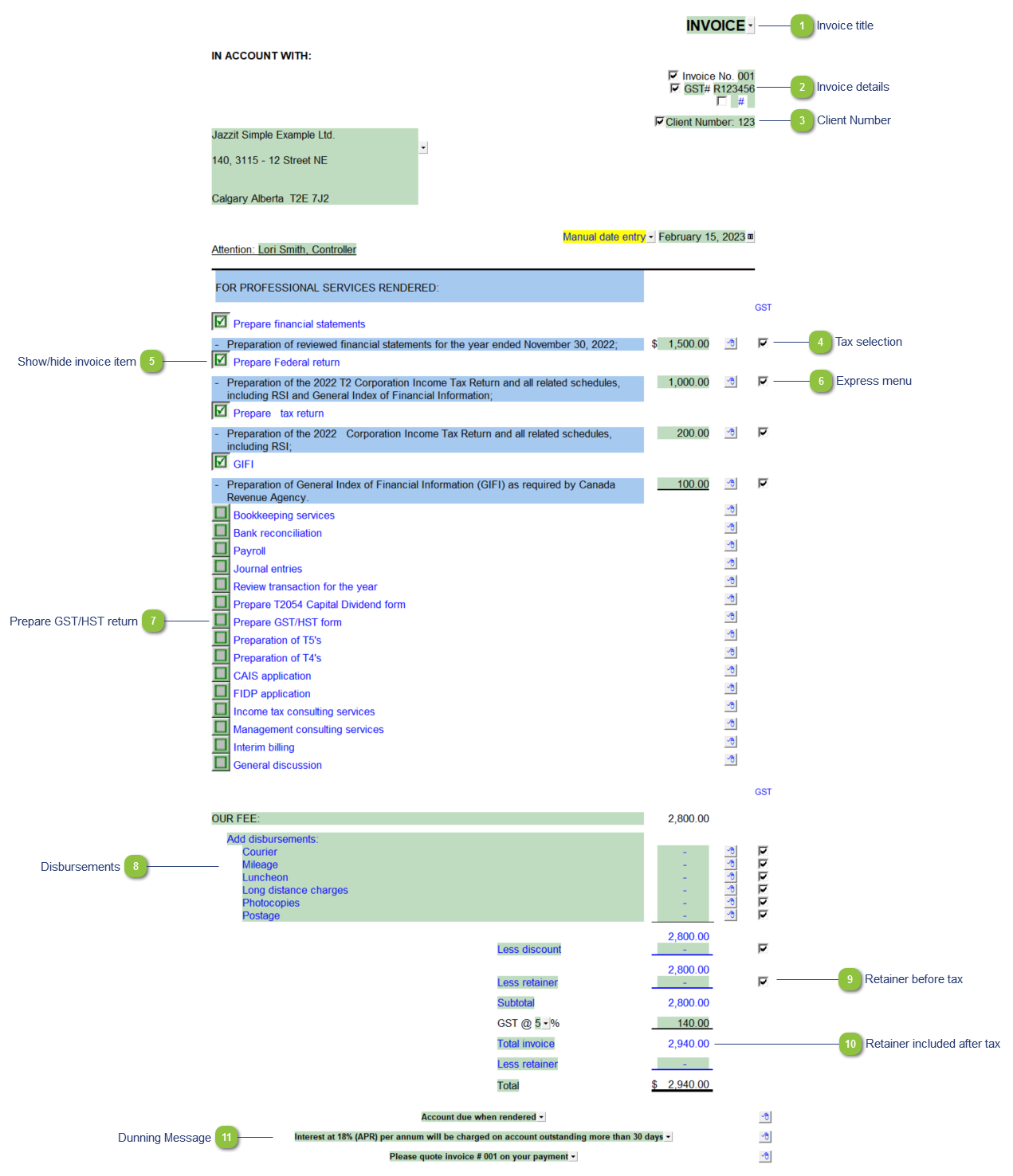

Client Invoice Highlights

Invoice title You can insert an Invoice title. Use the default title or enter your own title into the cell. Alternatively, use the popup menu and select the blank option to skip the heading.

|

Invoice details Use the checkbox to select to print or skip the invoice number and GST/HST number. Use the input cells to type in the invoice number and the GST/HST number.

|

Client Number |

Tax selection Uncheck the checkbox in the GST/HST column if the item is not subject to tax. This will adjust the GST/HST calculation at the bottom of the invoice accordingly.

|

Show/hide invoice item Switch on the relevant services by clicking on the green box to the left of the description and enter the details for each service.

|

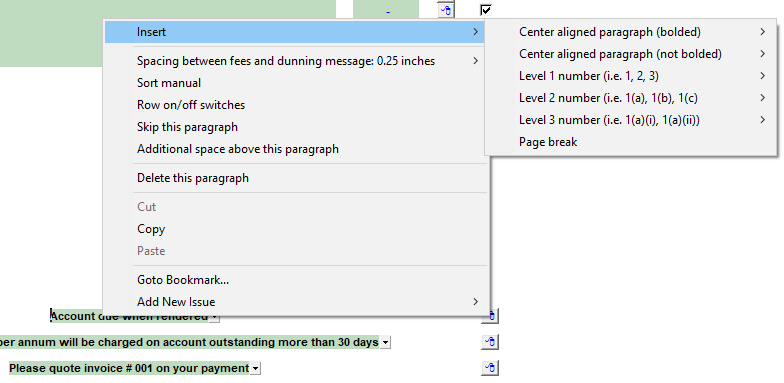

Express menu Right-click on the express menu to add more lines, sort or delete lines and format the section (adjust the spacing). |

Prepare GST/HST return The wording is based on Tax and Billing Options above. Setting between annual/quarterly/monthly will automatically set wording between 'return' and 'returns'.

|

Disbursements Add other fees and non-taxable fees and disbursements.

|

Retainer before tax Choose to show the retainer fee before tax. This amount will be included in the tax calculation if the checkbox in the tax selection column is checked off.

|

Retainer included after tax Choose to show retainer fee after tax. This amount will not be included in the tax calculation.

|

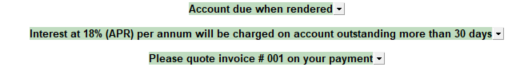

Dunning Message Right-click on the dunning message for formatting options.

|

|