Selecting Rounding Accounts

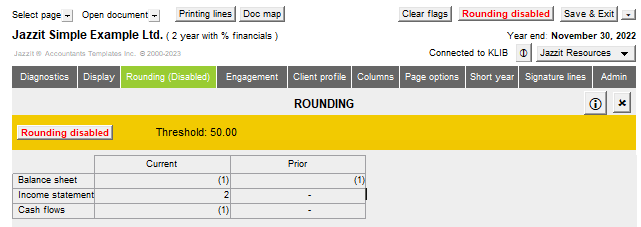

Rounding differences are applied to designated rounding accounts when the Rounding feature is activated. Rounding accounts for each statement (Balance sheet, Income statement & Cash flow) and period can be selected individually.

|

|

The rounding accounts are set back to default if the statement is updated from the Resource Centre.

|

-

In the Home menu > Rounding section, locate the statement and period for which you want to assign a rounding account.

-

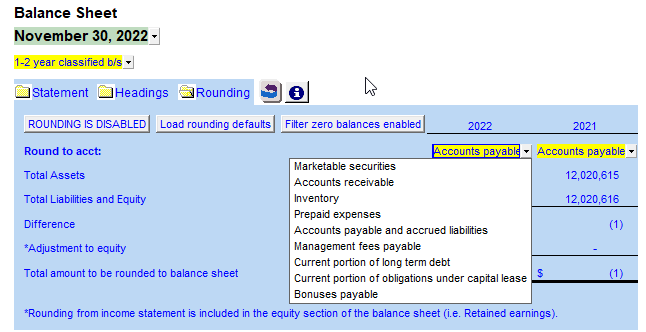

In the Current or Prior year column, double-click the cell for the Statement you wish to change. You will jump to the Rounding Information section at the top of the selected statement. You can also scroll directly to the desired statement and click on the small folder next to Rounding to open that statement's rounding section.

-

Click on the

button to view and select the desired rounding account from the popup list.

button to view and select the desired rounding account from the popup list. -

When the rounding is disabled, the balance difference for each statement are displayed.

-

Click on the button entitled "Rounding disabled" or "Rounding is Disabled" to activate rounding.

Points to keep in mind when selecting rounding accounts

-

Do not round to accounts with zero balances.

-

Avoid rounding to flip accounts. Flip accounts are those which may be either an asset or liability depending on whether the ending balance is a debit or credit (i.e., due to shareholders, related parties, cash/bank indebtedness).

-

Avoid rounding to accounts which reference notes (the rounding may cause a difference between the note and the amount on the statement).

-

You will not be able to round to any new lines you insert in statements, only existing lines.

-

If you have only cash and equity on your balance sheet and are not including a statement of changes or cash note, you can change the map number for term deposits (113.1181) to cash (111.1000) and you will be able to select cash as your rounding account.

-

The Income Statement can be rounded to any default expense account (i.e. you cannot round to new lines inserted in that section).

-

Statement of Cash Flow is rounded to any of the first 10 non-cash working capital items (indirect) or operating activities (direct) listed on the cash flow statement.

-

When preparing a file using Caseware’s consolidation feature, be sure to review which entity the rounding should be set to, most times it is set to the parent even though you may have selected another entity for the balances in the Income Statement.

-

Keep in mind that the amount rounded in the Income Statement will affect the final net income which will then affect the rounding on the Balance Sheet through retained earnings. This may mean that although there may be differences between assets and liabilities and equity on the Balance Sheet, the adjustment flowing from the Income Statement may change the final amounts to be rounded on the Balance Sheet to be zero.

-

Make sure that the account you round to appears only once in the statement. Rounding is applied to every line where the rounding account matches the account description. If the account appears more than once in the statement, your rounding may move from Disable directly to Recalc when switched on.

|

|

When you enable rounding, any differences are automatically adjusted to specified rounding accounts regardless of the amount.

|

|

|

Do not round to an unassigned map number (999).

|